How Linux development models the networked world for the rest of us.

In 1937, Ronald Coase gave economics something new: a theory for why companies should exist (www.economist.com/news/leaders/21584985-anyone-who-cares-about-capitalism-and-economics-should-mourn-death-ronald-coase-man). Oddly, this hadn't come up before. His paper was called “The Nature of the Firm” (https://en.wikipedia.org/wiki/The_Nature_of_the_Firm). He wrote it at age 27, as a class assignment in grad school. He based it on a talk he gave at 22. It has since earned him a Nobel prize.

Says The Economist:

Mr Coase argued that firms make economic sense because they can reduce or eliminate the “transaction cost” of going to the market by doing things in-house. It is easier to co-ordinate decisions. At the time, when communications were poor and economies of scale could be vast, this justified keeping a lot of things inside a big firm, so car-makers often owned engine-makers and other suppliers.

In that same piece (a 2013 obituary for Coase), The Economist adds:

Mr Coase's theory of the firm would suggest that firms ought to be in retreat at the moment, because technology is lowering transaction costs: why go to the bother of organising things under one roof when the internet lowers the cost of going to the market?

Could be that Coase has an answer for that one too. In a 2012 interview with Russ Roberts on the EconTalk podcast, when Coase was 102 years old, he said, “It's not possible to study how things are dealt with without realizing the importance of the stupidity of human behavior” (www.econtalk.org/archives/2012/05/coase_on_extern.html).

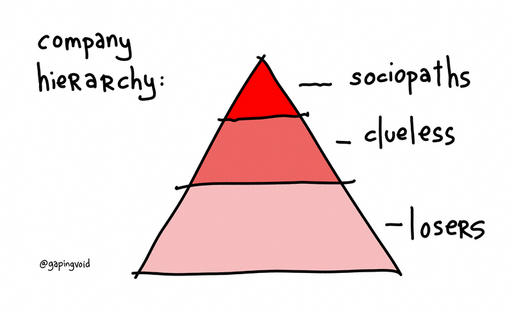

Perhaps that's why Hugh MacLeod (aka @gapingvoid, gapingvoid.com) in 2004 produced the cartoon shown in Figure 1 outlining his own model for the firm.

Figure 1. Cartoon by Hugh MacLeod (aka @gapingvoid) from 2004 that outlines his own model of the firm.

That same year, Hugh and I brainstormed the future of business for a (now gone) open-source company we both consulted. As happens with Hugh, this generated lots of great illustrations. Figure 2 shows Hugh's drawing of a company like the one above, embodying what he called “egology”.

Figure 3 shows what we both saw happening, inevitably.

That ecology was, and remains, the internet. The lines and dots in Figure 3 are employees and customers, all more native to the networked world than to any employer or “brand”.

“The Internet is nothing less than an extinction-level event for the traditional firm”, writes Esko Kilpi in his new book, Perspectives on new work (https://twitter.com/eskokilpi). That's because, as Vint Cerf puts it in the forward, Esko sees “a new kind of workforce” that will be “more independent and inter-dependent than workers of the past”, thanks to the net. Before the net, full independence and inter-dependence for workers was hard or impossible. Now it is becoming necessary.

Work also happens on the demand side of the marketplace, where the customers are. That's us. We far outnumber the companies we sustain with our money and our sentiments. When we become fully independent and inter-dependent, we will cease being grass roots and instead become forests of trees. And when that happens, companies on the supply side must adapt or get composted.

Adaptation will require making the most of everybody who is both independent and inter-dependent: workers on the inside and customers on the outside. No more losers working for sycophants and sociopaths. And no more consumers content with being captive in silos and walled gardens. If your company continues to look toward customers as just “consumers” to “target”, “capture”, “acquire”, “manage”, “control” and “lock in”, you're manure.

The model for how people work in the new economy was, and remains, open-source programming. That's what Hugh and I saw in 2004, and the observation hasn't changed.

Prime example: Linux kernel hackers. Their Linux work is for the kernel—meaning the whole world that depends on that kernel—and not just for their employers. If anyone wants to dispute that, I suggest reading what I wrote about it for Linux Journal in 2005 (www.linuxjournal.com/article/8664) and 2008 (www.linuxjournal.com/content/linux-now-slave-corporate-masters). The case (made by Linus Torvalds and Andrew Morton) hasn't changed.

In a fully networked workplace and marketplace, everybody who works for a company needs to be just as independent and inter-dependent as a Linux kernel hacker. And everybody in the marketplace should be the same.

Once the results of that independence and interdependence start to pay off, the market will flatten, because the connections will disintermediate systems built to capture and control, rather than to liberate and enable. Egology will drown in ecology.

But what will make this happen? In a word, cost. In the networked world, holding employees and customers captive is more costly than liberating both and letting the whole market do its work.

For years I've been saying that free customers will prove more valuable than captive ones. A corollary is that free markets will prove more valuable than captive ones. Same causes, same effects.

Right now we are part-way there, staging the flattened future with new “disruptive” intermediaries that appear to create a whole new model, when in fact they're the old model done better. But hey, it's a start. Case in point: Uber. As I write this, Uber is worth $70+ billion, while also losing $1.2 billion in the first half of this year (www.bloomberg.com/news/articles/2016-08-25/uber-loses-at-least-1-2-billion-in-first-half-of-2016)—nice work if you can get it.

It's easy to think of Uber as a new kind of company, but it's not. You can tell it's not when you ask yourself this question: Why not hire a ride from anybody who has one, rather than just through Uber or Lyft? Slick and cool as both of those are, they're just hacks on dispatch, which is a centralized intermediating system. The better hack will be one that connects demand with supply directly, on an individual basis. When you call for a ride, it should ring up everybody in a position to provide it, including Uber, Lyft, your neighborhood taxi and car services, and everyone else in the market for selling an open passenger seat.

How do we get there? Start with customers. Equip demand to drive supply directly. Equip everybody to participate. Not in a value chain, but rather in a value constellation, throughout which costs are reduced and benefits increased for everybody.

Look at it this way: the marketplace is a kernel space. Any of us can make it work better for all of us.